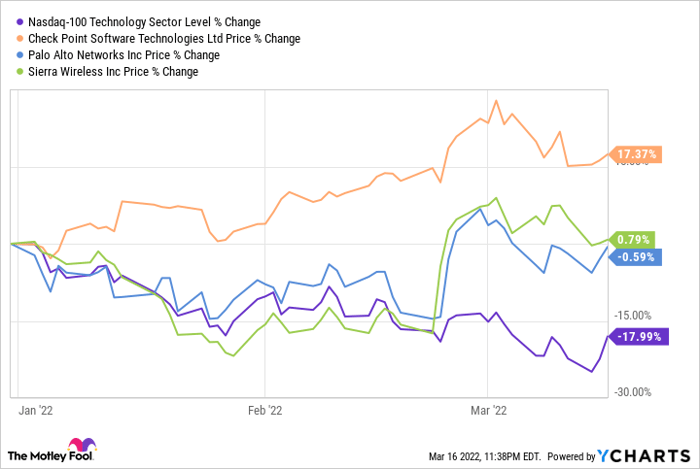

2022 has ushered in important volatility amongst generation shares. Buyers are staying clear of them (and different sectors too) because of financial turmoil caused by emerging rate of interest hikes, surging inflation, oil worth hikes, persevered U.S.-China tensions, and Russia’s invasion of Ukraine. A transparent signal of the volatility is the Nasdaq-100 Generation Sector dropping 15.6% of its worth up to now this yr.

In spite of the massacre in the marketplace, a couple of shares have held their flooring. Take a look at Level Instrument Applied sciences (NASDAQ: CHKP), Sierra Wi-fi (NASDAQ: SWIR), and Palo Alto Networks (NASDAQ: PANW) are 3 corporations defying the wider inventory marketplace sell-off (see the chart under) because of the powerful call for for his or her merchandise.

^NDXT information by way of YCharts

Let’s examine what is using those corporations’ enlargement, and why they might develop into forged buys within the present setting.

1. Take a look at Level Instrument Applied sciences

Take a look at Level’s inventory has grew to become in a forged efficiency in the marketplace this yr up to now, with positive aspects of greater than 17%. The cybersecurity specialist’s spectacular run can also be attributed to 2 components: its slightly affordable valuation and the acceleration in its subscription trade, which issues towards more potent enlargement someday.

Symbol supply: Getty Photographs.

Take a look at Level is buying and selling at 22 instances trailing profits and 18.5 instances ahead profits. That is less than the Nasdaq-100’s price-to-earnings ratio of 30 and the ahead profits a couple of of 23.5. This slightly affordable valuation has acted in Take a look at Level’s prefer this yr as buyers have made up our minds to offload richly valued tech shares which may be stung by surging inflation.

This sexy valuation, blended with Take a look at Level’s forecast for more potent gross sales enlargement this yr, has stored buyers in prime spirits.

Take a look at Level expects to ship as much as 10% income enlargement in 2022 to $2.38 billion on the prime finish of its steerage vary, following a 5% building up in 2021. A better take a look at the corporate’s key metrics signifies that it’s well-positioned to succeed in double-digit enlargement this yr. The corporate’s deferred income within the fourth quarter of 2021 larger 15% yr over yr to $1.7 billion, outpacing the true income enlargement of 6% to $599 million all through the quarter.

Deferred revenue is the cash amassed upfront by way of an organization for services and products that will likely be delivered later. The road merchandise is handled as a legal responsibility when the cash is amassed and is known as precise income as soon as the carrier supply occurs. The speedier tempo of enlargement on this metric is a results of the expansion in Take a look at Level’s subscription trade, which is being pushed by way of the call for for its other cybersecurity merchandise that give protection to information facilities, Internet of Things (IoT) gadgets, networking gadgets, and the cloud, amongst different pieces.

Extra in particular, Take a look at Level’s subscription trade grew 13% in 2021 to $755 million following a ten% building up in 2020. As subscriptions accounted for 35% of the corporate’s general income remaining yr, Take a look at Level has extra space for enlargement in this entrance. Additionally, Take a look at Level is the fourth-largest seller of cybersecurity home equipment, with a marketplace percentage of simply over 9%. The corporate is having a look to realize extra percentage on this marketplace: It plans to make bigger its gross sales pressure by way of 25% this yr, which must lend a hand Take a look at Level make a bigger dent within the profitable cybersecurity marketplace ultimately.

2. Sierra Wi-fi

Sierra Wi-fi’s inventory has remained flat up to now in 2022, however that could be a forged appearing making an allowance for the state of the wider inventory marketplace. On the other hand, Sierra inventory has gained momentum of past due following the corporate’s sturdy fourth-quarter 2021 effects, launched on Feb. 22.

Sierra Wi-fi’ fourth-quarter income shot up 24.4% yr over yr to $150 million as call for for its IoT chips remained sturdy. What is extra, the chipmaker ensured that it had sufficient stock available to fulfill the call for for its chips, that are used to energy IoT modules, services and products, networking, and different programs.

Sierra additionally swung to an adjusted benefit of $0.03 in keeping with percentage, in comparison to a lack of $0.19 in keeping with percentage within the year-ago duration. For the present quarter, Sierra anticipates $142.5 million in income on the midpoint of its steerage vary, which might be a 32% building up over the prior-year duration. So the chipmaker’s enlargement is set to modify into a better equipment this quarter, and it would not be sudden to peer the momentum proceed because of the booming call for for IoT connectivity chips and comparable services and products.

Mordor Intelligence estimates that the worldwide IoT chip marketplace may exceed $27 billion in worth by way of 2026, in comparison to $12 billion in 2020. No longer unusually, Sierra Wi-fi consumers have already began hanging orders for chips that will likely be shipped in 2023. In all, Sierra may experience secular long-term enlargement because of the put it up for sale operates in, and is the reason why analysts be expecting the corporate’s profits to extend at an annual fee of 15% over the following 5 years.

Sierra’s attainable enlargement makes it an attractive IoT inventory to shop for at the moment, as it’s buying and selling at simply 1.4 instances gross sales. That price-to-sales multiple represents a pleasant cut price to the S&P 500‘s a couple of of two.76, which is why buyers having a look to shop for an explosive enlargement inventory at the moment mustn’t omit Sierra Wi-fi.

3. Palo Alto Networks

Palo Alto Networks’ inventory gained a shot within the arm following the corporate’s fiscal 2022 second-quarter effects launched on Feb. 22. The cybersecurity specialist delivered stronger-than-expected numbers and raised its full-year steerage, indicating that its prime tempo of enlargement is right here to stick.

Palo Alto’s fiscal Q2 income was once up 30% over the prior-year duration to $1.3 billion, and its steerage for the present yr issues towards a 28% leap within the most sensible line to $5.45 billion.

It’s value noting that Palo Alto’s ultimate efficiency responsibilities jumped 36% yr over yr all through the quarter to $6.3 billion, which is larger than its trailing-12-month income of $4.86 billion. This metric denotes the full worth of purchaser contracts which are signed however haven’t begun to be fulfilled.

The rest efficiency responsibilities will likely be recorded as income at the source of revenue remark as soon as they’re fulfilled. So the more potent enlargement on this metric as in comparison to the true income enlargement at Palo Alto issues towards a forged long run income pipeline that are meant to lend a hand the corporate take care of its spectacular enlargement momentum.

One more reason why Palo Alto must have the ability to maintain its prime ranges of enlargement is as a result of the corporate’s percentage of the cybersecurity marketplace. The corporate occupies the second one place within the safety equipment marketplace, consistent with marketplace analysis company IDC. Palo Alto managed 15.2% of the worldwide safety equipment marketplace within the fourth quarter of 2021, simply at the back of Cisco Methods‘ percentage of 15.3%.

With the worldwide cybersecurity marketplace anticipated so as to add just about $9 billion in income over the following 4 years, Palo Alto Networks’ percentage of this house must give its most sensible line a pleasant spice up. The profitable end-market alternative and the cybersecurity specialist’s powerful percentage let us know why analysts be expecting its profits to extend at an annual tempo of 25% for the following 5 years.

All of this tells us that Palo Alto Networks is an explosive growth stock to shop for, because the put it up for sale operates in is likely to get a boost within the present geopolitical situation.

10 shares we love higher than Take a look at Level Instrument Applied sciences

When our award-winning analyst group has a inventory tip, it may possibly pay to pay attention. In the end, the e-newsletter they have got run for over a decade, Motley Idiot Inventory Consultant, has tripled the marketplace.*

They simply published what they imagine are the ten best stocks for buyers to shop for at the moment… and Take a look at Level Instrument Applied sciences wasn’t one among them! That is proper — they believe those 10 shares are even higher buys.

*Inventory Consultant returns as of March 3, 2022

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot owns and recommends Take a look at Level Instrument Applied sciences, Cisco Methods, and Palo Alto Networks. The Motley Idiot recommends Nasdaq. The Motley Idiot has a disclosure policy.

The perspectives and evaluations expressed herein are the perspectives and evaluations of the creator and don’t essentially mirror the ones of Nasdaq, Inc.