By way of Liqian Ren

Director of Fashionable Alpha

Remaining week, China’s State Council launched a readout of the monetary balance and construction committee assembly chaired by means of Vice Premier Liu He. It used to be a normal assembly however supposed to handle ongoing monetary considerations—specifically, the collapsing Chinese language inventory marketplace, in particular offshore China equities. The marketplace went into an excessive rally in Hong Kong, adopted by means of a vital rally in U.S. offshore China shares.

The readout used to be supposed to address the common concerns contributing to falling stocks.

It addressed buyers’ primary considerations on macroeconomic prerequisites and insurance policies, chance within the Chinese language actual property marketplace, the legislation of platform corporations and the audit regulatory courting between the U.S. and China.

Media headlines right here within the U.S. have been extra sure than the true Chinese language phrases of the discharge.

As an example, it by no means stated or implied “legislation on Large Tech will finish quickly,” however that’s one of the crucial headlines in every single place English media. The readout simply stated it will have to briefly put in force the present plans for massive platform corporations in a clear measure, coordinate information releases amongst departments and no longer disenchanted the capital marketplace with any unexpected information. This implies the federal government has extra plans it needs to put in force. As an example, after Ant Team is requested to spin off the fee a part of its trade, it’s anticipated Tencent will face one thing equivalent.

So, what did the federal government accomplish?

It did exchange the narrative clear of consistent “China Tech Crackdown” headlines.

What did it no longer accomplish?

It didn’t exchange a lingering concern that the Chinese language govt is shedding credibility that it is going to put financial enlargement because the perfect precedence with precise insurance policies.

In particular, listed below are the lingering worries:

- Is the PBoC (People’s Bank of China) fascinated with the use of financial gear like a big rate of interest reduce to stimulate the financial system?

- How critical is China about operating with the PCAOB (Public Corporate Accounting Oversight Board) to fulfill the necessities of the HFCAA (Conserving International Corporations Responsible Act)? We consider this chance might be controlled, since greater than 90% of the WisdomTree ex-State-Owned China Index is already buying and selling Hong Kong or Chinese language home stocks, no longer U.S. stocks, as many large-mid corporations have a twin proportion record, and liquidity in Hong Kong has considerably progressed.

- How critical is the federal government’s fiscal stimulus? After the assembly readout, the Ministry of Finance stated its assets tax experiment would no longer amplify to further towns this 12 months. This can be a very small fiscal affect factor, and extra concrete and bolder tax cuts and spending insurance policies are had to make Liu He’s course of action credible.

Russia’s invasion of Ukraine is growing any other headwind for China, because it faces the danger of secondary sanctions from the U.S. and Eu international locations.

A decoupling of U.S.-China in key sectors like semiconductors has already begun, with more sectors to come.

Russia is China’s quick northern neighbor and a significant provider of power. Extensively outlined, China has misplaced vital territory from Russian pressures over an overly lengthy historical past. There may be an higher distrust of the U.S., as loads of Chinese language corporations were put at the U.S. sanctions checklist since 2016.

These days, the phrase China’s been the use of is “impartial” overseas members of the family, no longer “impartial,” as it couldn’t and gained’t utterly bring to an end from Russia. Anecdotally, simply within the final two days, there was some shift in home media towards pro-Ukraine protection, as China’s president talked with President Biden on March 18.

China’s dynamic 0 COVID-19 coverage may be nonetheless in position, struggling with Omicron with some lockdowns and mobilized checking out, because the prime transmission is making it more difficult to include like Delta. Thus far, its affect on production and the worldwide provide chain remains to be subdued, as Chinese language corporations have briefly realized to make use of Olympic bubble-style control to stay factories open. The affect of the home provider financial system is important, which can proceed to hose down home intake.

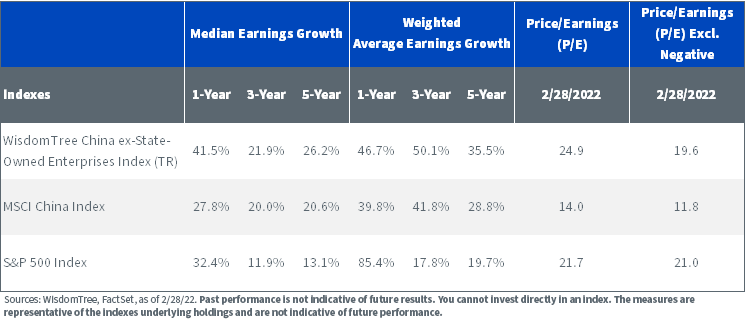

For buyers, our thesis on China remains to be profits. With our loose fund comparison tool, we will see that ex-state-owned corporations are nonetheless handing over vital profits enlargement.

We consider the Russian struggle and profits are the highest components to be aware of for China fairness. Can Chinese language corporations proceed earning profits within the face of these kinds of dangers?

That’s crucial query for long-term buyers.

For definitions of phrases within the chart above, please seek advice from the glossary.

For extra in this subject, please pay attention to certainly one of our newest China of The next day podcast, the place Liqian Ren speaks with Bruce Liu about world semiconductor business and China fairness.

China of Tomorrow by WisdomTree Asset Management

Interview with Esoterica Capital

In the beginning published by means of WisdomTree Investments on March 25, 2022.

Read more on ETFtrends.com.

The perspectives and evaluations expressed herein are the perspectives and evaluations of the creator and don’t essentially mirror the ones of Nasdaq, Inc.