The Inflation Aid Act is geared toward making the United States the go-to position for inexperienced funding by means of linking subsidies and tax breaks to house manufacturing. To stick aggressive, Europe wishes to concentrate on what it does easiest: set guidelines and wield its huge home marketplace, argue Karsten Neuhoff and Andreas Goldthau.

Karsten Neuhoff is head of local weather analysis on the German Institute for Financial Analysis and professor in Economics on the Technical College of Berlin. Andreas Goldthau is director on the Willy Brandt College of Public Coverage, professor on the College of Erfurt, and analysis team lead on the Institute for Complicated Sustainability Research in Potsdam.

A inexperienced commercial program of a few $400 billion in federal investment, the IRA has stuck Europe wrong-footed.

The fallout of Russia’s Ukraine struggle – strained public budgets and an sick economic system – have shifted coverage priorities and briefly put local weather insurance policies into the backseat. What’s extra, while the EU is historically just right at fostering marketplace festival, additionally in blank power, it’s much less so in nurturing inexperienced champions.

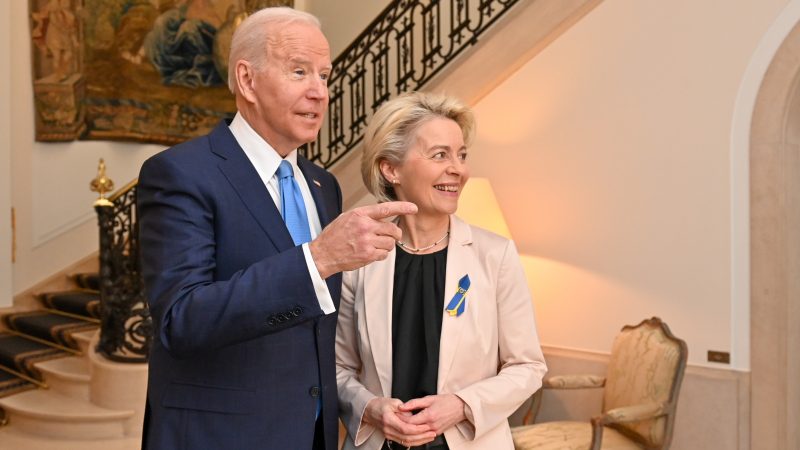

In line with the IRA, EU Fee President Von der Leyen introduced enjoyable state relief guidelines, for Eu governments to counter US fiscal sweeteners for inexperienced funding.

On the other hand, this measure misses the purpose. It pits the EU towards the United States and fosters a subsidy race throughout the Union, which the ones with the inner most wallet will win. It additionally falls quick of what’s had to advance the Eu economic system, and blank power coverage globally.

Europe’s promoting level has all the time been a rule-based and dependable coverage framework, which made home and global traders advance state of the art era in telecom, car or inexperienced power.

The EU’s power and local weather coverage define a coherent and regularly agreed imaginative and prescient for the longer term Eu financial style. Joined-up coverage motion must construct on it in accordance with US blank tech reshoring efforts.

Moderately than a lopsided focal point on state-aid guidelines, quite a few key coverage information will wish to be related, so that you could ensure that enough funding on the EU scale and to stay an exquisite spouse across the world.

First, insurance policies geared toward incentivising commercial manufacturing in high-carbon charge environments wish to be redesigned. Obviously, the advantage of the carbon border adjustment mechanism (CBAM), the EU’s protecting levy focused on carbon-heavy imports, lies in elevating world consideration to emissions pricing.

But, it fails to generate equivalent pay-offs and monetary beef up for EU-level commercial decarbonisation because the IRA. Because of this, international locations like Germany, Netherlands, France and Sweden will most likely scale up their nationwide carbon contracts for distinction to beef up inexperienced funding, significantly in fundamental fabrics, which dangers balkanising the EU marketplace.

An efficient CBAM to fund and incentivise EU commercial modernisation would require a unique design possibility: a local weather contribution particular to the kind of product, now not the site.

What sounds overly technical, necessarily quantities to a carbon levy on each home manufacturing and imports. Business competitiveness is ensured by means of waving the levy for exports.

At present carbon costs, this sort of levy would yield some 40 billion yearly, and – not like the IRA – be offering a long-term funding outlook. This units incentives for commercial emission aid around the EU by means of on the identical time developing revenues and addressing considerations about carbon leakage.

2nd, Europe must focal point its public investment technique on totally unlocking its wind- and sun possible around the continent. Suitable monetary preparations are central right here. The EU Fee has introduced a assessment of the marketplace design to incorporate contracts for variations and locational pricing.

Each parts might be crucial to give protection to traders towards regulatory possibility and effort customers towards monetary dangers of energy acquire agreements. Already by means of 2030, this may occasionally decrease financing prices for renewable power deployment, thus lowering power prices for business and families to the track of 8 billion according to 12 months whilst bettering coverage towards charge hikes.

3rd, Europe wishes to regulate its fuel marketplace style and make it have compatibility for function. As the sector’s biggest uploading bloc, Europe is – not like the United States – overly uncovered to geopolitical and marketplace uncertainties, which additionally throw up transition dangers at the manner in opposition to blank fuels.

Going again to long-term fuel contracts slightly is an possibility, additionally given the spectre of carbon lock-in. Contractual adjustments and worth controls by myself won’t do the trick.

As a substitute, the EU wishes to enrich price-based marketplace changes with efficient safety of provide protocol. As lately defined by means of 18 Eu economists, this sort of protocol may just mix nationwide fuel saving goals and a fuel allocation mechanism with a value cap by means of mandating fuel transmission device operators to pay a restricted charge for provide shortfalls.

The convenience lies in setting up readability on regulatory possible choices all through emergency eventualities, thus lowering prices and dangers for fuel manufacturers and customers all through the transition length.

It’ll additionally stay world LNG costs in test, reaping benefits customers with decrease buying energy, e.g. in East Asia. Such measures may just save EU fuel consumers – or the governments these days investment fuel charge reduction methods – all through the disaster greater than 200 billion according to 12 months that may as an alternative be invested into the power transition.

After all, Europe will wish to construct on cooperation. This can be a mixture of honest and predictable guidelines, investment for team spirit and an exquisite shared imaginative and prescient that experience decided the good fortune of the Eu Union in addition to its newest grand challenge, the EU Inexperienced Deal.

Globally, it’s most likely to take action additionally in terms of cooperating with pivotal rising economies like India, Brazil, Indonesia or South Africa at the inexperienced transition.

Those countries will log out on a joint local weather and commercial coverage if constructed on a strong framework. A Local weather Alliance can then praise formidable motion at house by means of sharing in monetary flows; leap forward alliances can change into make a selection sectors corresponding to metal or cement; power transition partnerships can set out joint spaces of era cooperation.

To this finish, EU coverage frameworks wish to be aligned with the desires of such world cooperation. The investment backing up world local weather alliances and partnerships, together with for commercial transition, can also be secured by means of local weather contributions raised amongst taking part financial blocs.

Moderately than becoming a member of in a world inexperienced race this is unique and focused at commercial reshoring, Europe must take sensible possible choices geared toward accelerating the home power transition, mobilising finances and strengthening world rules-based cooperation.

Without equal impact might be a extra sustainable and lasting transformation and person who coopts slightly than antagonises the longer term financial powerhouses within the World South.