AppleInsider might earn an associate fee on purchases made via hyperlinks on our website.

Apple will probably be pronouncing its 2023 fiscal first quarter effects on February 2. Here is what to anticipate from the vacation quarter profits — and what Wall Boulevard is predicting.

Apple published on January 4 that it is going to be maintaining its investor call on Thursday, February 2, at 2:00 PM Pacific, 5:00 PM Jap, to talk about the primary fiscal quarter profits unencumber from previous within the day. In accordance with the standard timeline for effects, main points will have to be launched through Apple about part an hour earlier than the decision itself.

For the decision, CEO Tim Cook and Luca Maestri will speak about the well being of Apple during the last 3 months, together with product launches and gross sales, damaging occasions, and different financial headwinds that would impact the quarters to come back.

As standard for Apple for the reason that get started of the pandemic, the corporate hasn’t presented formal earnings steering for the quarter on the time of its earlier profits document.

Profits for the quarter are in most cases the best possible because of Apple’s extremely seasonal gross sales, in addition to an inventory of key product launches.

Then again, strangely for the quarter, Apple did factor an uncharacteristic notice about iPhone manufacturing in November. Because of COVID-19 problems at Foxconn’s Zhengzhou factory, the provision of the iPhone 14 Pro and iPhone 14 Professional Max was once interrupted, prompting Apple’s understand.

On the time, the click unencumber admitted the manufacturing facility operated at a “considerably diminished capability,” even though it has since stuck up. Apple additionally stated it persisted to peer “robust call for” for the Professional fashions, but in addition anticipated decrease shipments and longer wait occasions for patrons.

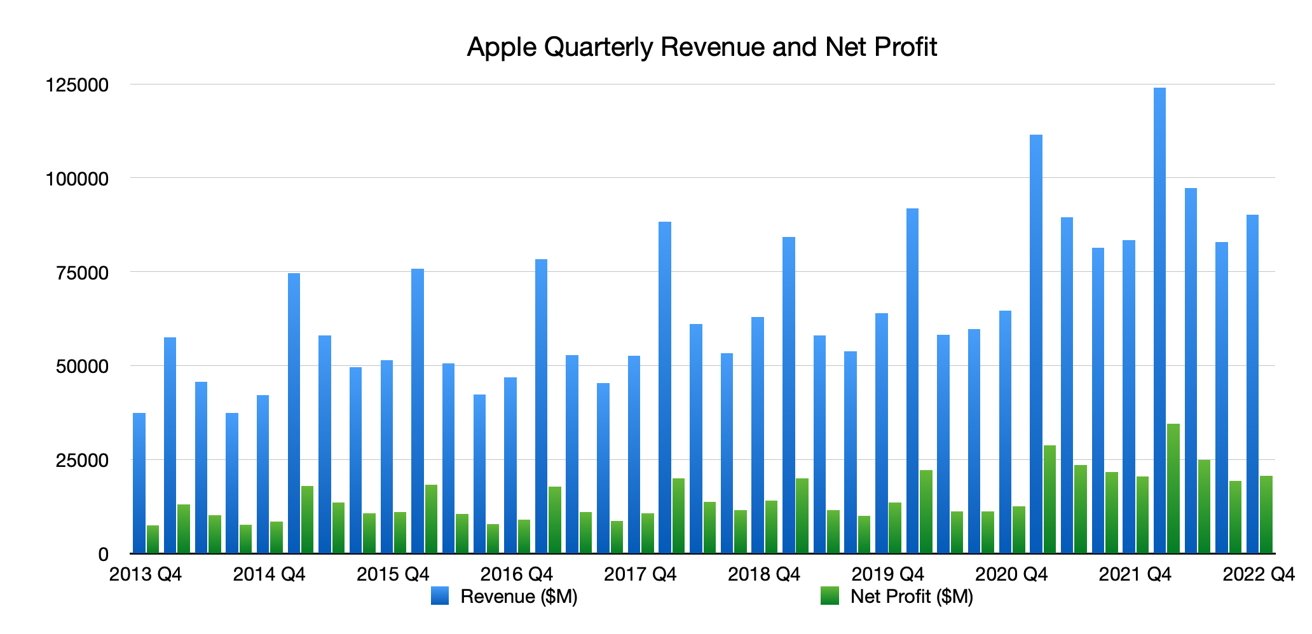

Apple’s Q1 2023 figures have to overcome significantly prime figures reported 365 days in the past in Q1 2022. At the moment, it reported an 11.2% YoY build up in earnings to $123.9 billion, with a web benefit of $34.6 billion additionally record-setting and an annual build up of 20.4%.

For Q1 2022, the iPhone introduced in $71.6 billion in earnings, with Mac earnings additionally as much as $10.8 billion within the quarter. Wearables, House, and Equipment was once as much as $14.7 billion in earnings, Services and products noticed a YoY build up to $19.5 billion, however iPad earnings noticed a drop right down to $7.2 billion.

What’s the Wall Boulevard consensus on Apple’s vacation quarter?

As of January 23, the analyst consensus for the quarter is an profits in keeping with percentage of $1.95. This interprets into 1 / 4 with $122 billion in earnings. This compares to $123.9 billion within the year-ago quarter.

Consensus for the following quarter’s earnings is right now sitting at $98.2 billion, however many of the analysts in query chimed in earlier than the discharge of the brand new Mac Professional, up to date Mac minis, and a second-generation huge HomePod.

Particular person analysts on Apple

The iPhone 14 Professional cargo issues had been some degree of factor for analysts analyzing the corporate’s fortunes, with lower shipment forecasts of the fashions idea to closely affect earnings. Then again, some presented the view that shipments can be pushed into Q2 2023 gross sales as an alternative.

At one level in January, Apple’s marketplace capitalization dipped below $2 trillion, with buyers cautious of the provision chain issues and being attentive to analyst discussions at the corporate’s fortunes.

Daniel Ives and John Katsingris, Wedbush

Wedbush decreased its worth goal for Apple from $200 to $175 on January 4, at the foundation of it being a extra “unsure surroundings” for buying and selling, and over call for headwinds.

“Apple stays our favourite tech title,” the company stated whilst insisting it maintains its “Outperform” score for the inventory, however provide chain exams had been “obviously combined heading into the following few quarters,” with Apple additionally it appears chopping again some orders for merchandise.

On iPhone, call for for the iPhone 14 Professional is extra solid than feared, and that there’s a trust that the “general call for surroundings is extra resilient than the Boulevard is expecting.”

Samik Chatterjee, JP Morgan

On January 19, JP Morgan warned buyers it believes call for is falling rather throughout all of the Apple product catalog. Viewing the profits as a “tricky setup” because of provide headwinds, the troubles became “call for issues for the Mar-Q and past,” the company believes.

Income and profits for the primary quarter of 2023 will “observe modestly beneath consensus expectancies,” however the leave out will have to be “extra modest” than prior to now anticipated. JP Morgan additionally raised its December quarter estimates on provide monitoring, however added that weak spot in underlying call for will make the following quarter “similarly tricky.”

After reducing the associated fee goal in December 2022 from $200 to $190, JP Morgan went additional in January, pushing it to $180.

Canaccord

A January 22 notice had Canaccord Genuity Capital Markets reduce its worth goal for Apple from $200 to $170, whilst reaffirming the “purchase” score for inventory.

Call for for the Professional mannequin iPhones has been disappointing, however believes some misplaced December gross sales will probably be driven later into March. Contemporary channel exams point out {that a} four-week stay up for the top class fashions has all however evaporated.

Total call for has been slowing regardless of a powerful sell-through for iPhones, it provides, which items a extra pessimistic view for 2023 as a complete. There is a forecast of $68.3 billion for first-quarter iPhone gross sales, with a full-year estimate of $199.6 billion.

Different {hardware} may be liable to a significant decline in call for, with the upper worth issues of recent Macs making it onerous for Canaccord to peer if shoppers nonetheless have a “willingness to spend money on dearer merchandise” given a tricky macro backdrop.

Rosenblatt

On January 13, Rosenblatt Securities reduced its worth goal through $24 right down to $165, with iPhone manufacturing delays and “macro services and products headwinds” in charge.

A December survey discovered fewer folks keen to shop for or have purchased an iPhone 14 than a an identical survey in September, with purchasing intent for the iPhone 14 Professional Max lowering from 44% in September to 34% in December for that workforce.

Rosenblatt additionally echoed reviews that the App Retailer has bogged down, together with a double-digit % drop within the December quarter following expansion previous within the yr, which is “doubtlessly reflecting weakening sport revenues.”

In the long run, the analysts be expecting enhancements and gives that buyers might view this “as a throwaway quarter” and to as an alternative “focal point on later classes.”

UBS

In a Jan 23 notice to buyers, UBS stated it expects December earnings of $120.3B and an EPS of $1.93, not up to a consensus of $122.9B and $1.96. Comfortable vacation gross sales of Professional-model iPhones brought about from the Zhengzhou manufacturing facility problems has resulted in UBS forecasting 79 million gadgets shipped within the quarter, down from 80 million from the consensus.

Regardless of the decrease gross sales, UBS thinks that the robust Euro, Pound, Yen, and Yuan towards the greenback may just paintings in Apple’s want for its financials.

AppleInsider will probably be including extra analyst predictions earlier than the profits document.