Tactic, a startup that is helping companies set up — and simplify — cryptocurrency budget, is rising from stealth these days with $2.6 million in seed investment.

Founders Fund and finance automation startup Ramp co-led the lift for Tactic, an eight-person outfit based totally in New York Town. Elad Gil and Figma co-founder Dylan Box additionally participated within the investment.

CEO Ann Jaskiw based Tactic after finding out that founders in web3 have been dealing with their accounting in spreadsheets. Current accounting instrument suppliers, she concluded, “weren’t constructed to take care of crypto transactions.”

The core of Tactic’s product, mentioned Jaskiw, is to lend a hand a CFO or head of finance solution the query, “The place did the cash move?” on the finish of 1 / 4.

“At this time for most money execs, their audit path of crypto transactions is a debit transaction from Silicon Valley Financial institution or whichever financial institution, right into a centralized trade,” Jaskiw defined. “Like Coinbase tokens go away that central position, and it then turns into a large little bit of a query mark. What we’re seeing is individuals are spending a large number of time in guide spreadsheets, looking to monitor what transactions occur and looking to calculate their achieve and loss. It’s simply extremely bulky lately.”

Usually, firms interacting with blockchains battle to make sense in their fragmented job, in keeping with Jaskiw.

“They generally tend to control a couple of wallets throughout more than a few blockchains and grasp budget in centralized exchanges or self-custody answers like Gnosis Protected,” she mentioned.

That is the place Tactic is available in.

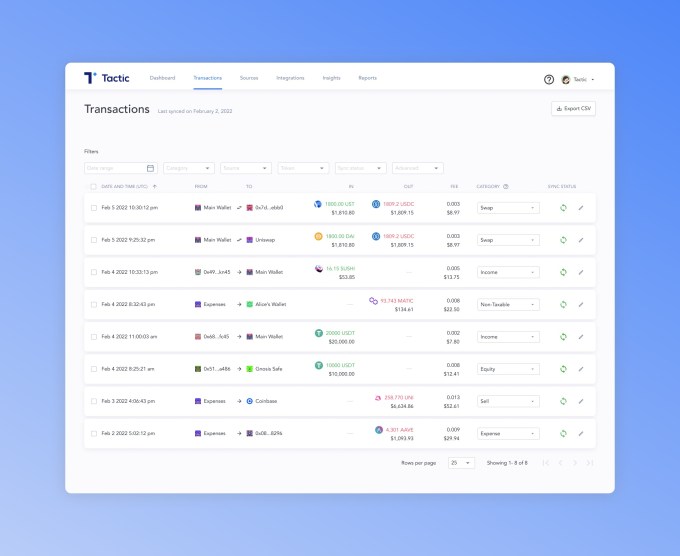

Tactic says it’s tackling the issue of accounting for a trade’s cryptocurrency holdings and on-chain job through aggregating information throughout disparate assets to provide companies “a complete treasury view in their balances and actions.” Its instrument, Jaskiw mentioned, is helping firms robotically categorize transactions and follow accounting good judgment akin to calculating $USD achieve/loss and taxable occasions. Accountants can then reconcile a trade’s crypto-subledger to conventional accounting instrument like QuickBooks.

“It doesn’t topic what they’re development, it may be any on-chain transaction,” Jaskiw mentioned. “However there’s simply no cohesive audit path if you happen to’re a crypto corporate. So when you’ve got an ordinary checking account, you’ve your entire blank inflows and outflows, and you’ll have a couple of checking account nevertheless it’s generally in one spot — while crypto transactions can span a dozen other wallets or merchandise.”

After chatting with masses of businesses, Tactic discovered that decentralized finance or “DeFi” transactions have been probably the most problematic. For instance, in keeping with Jaskiw, a unmarried interplay with a sensible contract can generate masses of “nested transactions,” all of which wish to be damaged out for accounting functions.

Tactic, she mentioned, has partnered with accounting corporations to lend a hand interpret accounting tips for DeFi-specific actions akin to staking, NFT minting and airdrops.

Since its 2021 release, Tactic says it has signed up “dozens” of consumers, starting from early-stage startups to billion-dollar enterprises throughout industries together with NFTs, protocols and DeFi. The corporate is designing its providing to paintings with companies that experience “masses of hundreds” in transaction volumes per 30 days.

“It is a ache level for everybody,” Jaskiw advised TechCrunch. “The larger a company will get, the extra complicated and worse the issue will get. In order that’s the place we’re seeing probably the most pleasure about this.”

She additionally believes {that a} not unusual false impression in regards to the crypto house is that a large number of individuals are looking to keep away from law. Tactic, Jaskiw mentioned, has discovered the other to be true.

“Numerous firms, the personal C corps within the U.S. in particular, are in reality looking to do the correct factor, observe the foundations and keep compliant,” she mentioned. “They simply at this time lack one of the vital tooling and steerage so to do this successfully.”

Symbol Credit: Tactic

John Dempsey, Tactic’s VP of technique and ops, says that Tactic makes it “simple” for companies to transact in cryptocurrency, “understanding they are able to set up their monetary job in a blank, compliant means.” Dempsey is former VP of product at blockchain forensics company Chainalysis, a blockchain research corporate that remaining March closed on a $100 million Series D financing, doubling its valuation to over $2 billion.

However it’s no longer simply web3 firms suffering with the problem.

Crypto is “hastily penetrating” even non-crypto firms, in keeping with Scott Orn, COO of Kruze Consulting, a CPA company that serves startups.

“Crypto is readily changing into a part of the monetary infrastructure of many startups. We’re seeing 5% to ten% of our non-crypto SaaS firms attractive in crypto transactions — the ones are SaaS firms that experience not anything to do with crypto,” Orn advised TechCrunch. “Two years in the past nearly no non-crypto firms have been the use of crypto — that’s lovely amazingly rapid expansion.”

In the meantime, he added, crypto introduces a bunch of accounting problems that are supposed to be solved through instrument, together with reserving transactions appropriately into the overall ledger, recording tax making plans data and dealing with good contract-generated transactions.

Crypto transactions can create taxable occasions, issues out Orn.

For instance, an organization has a freelance to receives a commission a particular collection of crypto tokens, and if the ones tokens building up in worth ahead of the corporate in reality will get paid, that would lead to “massive income spikes.”

“This may push a startup into profitability, which means taxes are owed,” Orn added. “And promoting crypto belongings that experience larger in worth creates a taxable achieve. We’ve observed either one of those situations, and keeping an eye on all of it manually is hard in a high-volume scenario.”

Founders Fund Most important Leigh Marie Braswell mentioned that Tactic’s product is “already saving crypto accounting groups days every month.”

“We consider Tactic has the prospective to develop into an enormous participant as extra firms transfer into web3,” she added.

Eric Glyman, Ramp CEO and co-founder, advised TechCrunch that his corporate invested in Tactic in keeping with the realization that there’s a want for “easy, intuitive answers for companies transacting with crypto.”

“We await that call for will simplest develop at some point,” he mentioned.

Glyman additionally noticed what he described as “strategic alignment” with Ramp’s long-term imaginative and prescient (Observe: The corporate secured its personal investment previous this yr at an $8.1 billion valuation).

“Tactic is constructed with the intent to save lots of companies time and it’s distinctive in that the platform works for corporations that experience excessive transaction volumes,” he mentioned. “And the whole thing we do at Ramp is in toughen of saving companies money and time.”

Tactic plans to make use of its new capital to construct out its product and staff.

“We haven’t needed to do any exterior advertising or operating of advertisements,” Jaskiw mentioned. “We’ve been getting a large number of inbound pleasure.”