Disclaimer: The ideas introduced does now not represent monetary, funding, buying and selling, or different varieties of recommendation and is simply the author’s opinion

- The technical signs shed no mild on the future of Ethereum

- With decrease liquidity available in the market, fast strikes to cause a mass of stop-loss orders prior to a momentary reversal are conceivable

Ethereum [ETH] witnessed very low volatility up to now few days. Since 20 December the cost caught to the $1,213 mark. This will also be attributed to the vacation season. But, crypto markets by no means sleep, and ETH buyers can glance out for a transfer into a space of importance.

Learn Ethereum’s [ETH] Price Prediction 2023-2024

As an example, $1,245 and $1,350 are two spaces the place the bulls will run into numerous dealers. With Bitcoin additionally experiencing a muted length of sideways buying and selling, what path will the rage be when one emerges?

Ethereum reclaims mid-range however may just see a dip another time to fill huge orders

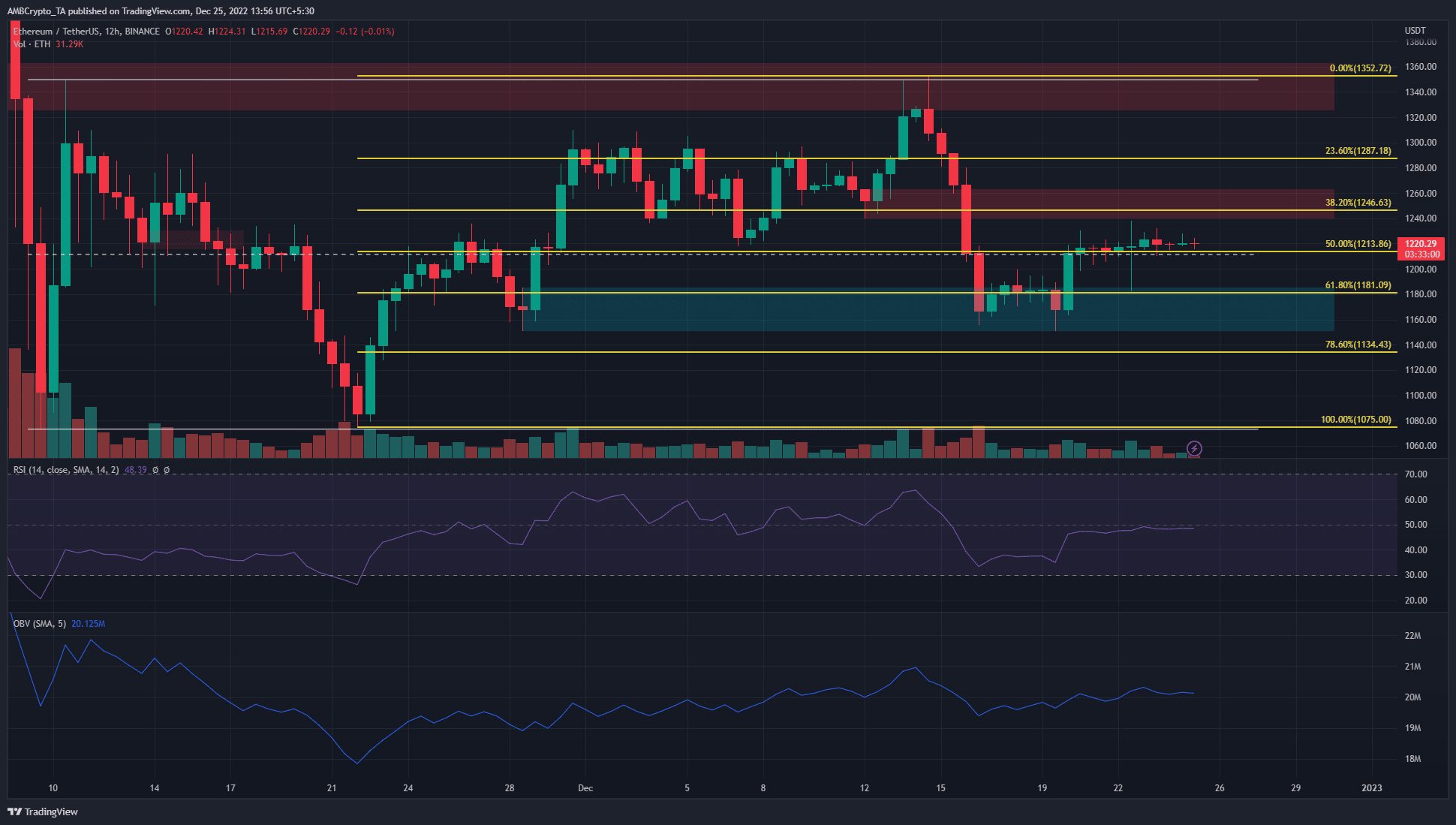

The marketplace construction shifted to a bullish bias on decrease timeframes when ETH upward push from $1,160 and was once ready to upward push above the $1,190 mark over the last week. Alternatively, the buying and selling quantity and the volatility were reasonably low in contemporary days. This supposed that the cost may just see a big deviation north or south searching for liquidity prior to a snappy reversal.

This will pass both method. ETH may just upward push to tag the H12 breaker at $1250 prior to plunging to $1160 another time. The opposite was once additionally similarly most likely. Due to this fact a dealer can watch for a pattern to determine itself. The Relative Power Index (RSI) has been as regards to the impartial 50 mark in contemporary days to suggest momentum liked neither the patrons nor the dealers.

Are your ETH holdings flashing inexperienced? Take a look at the Profit Calculator

The Fibonacci retracement ranges plotted have been additionally necessary. In the following couple of days, a transfer above the 38.2% degree or beneath the 61.8% degree, adopted by means of a retest, may just function a cause for a dealer to focus on the respective extremes of the variety (white). The variability top is at $1,350 and the low is at $1,073.

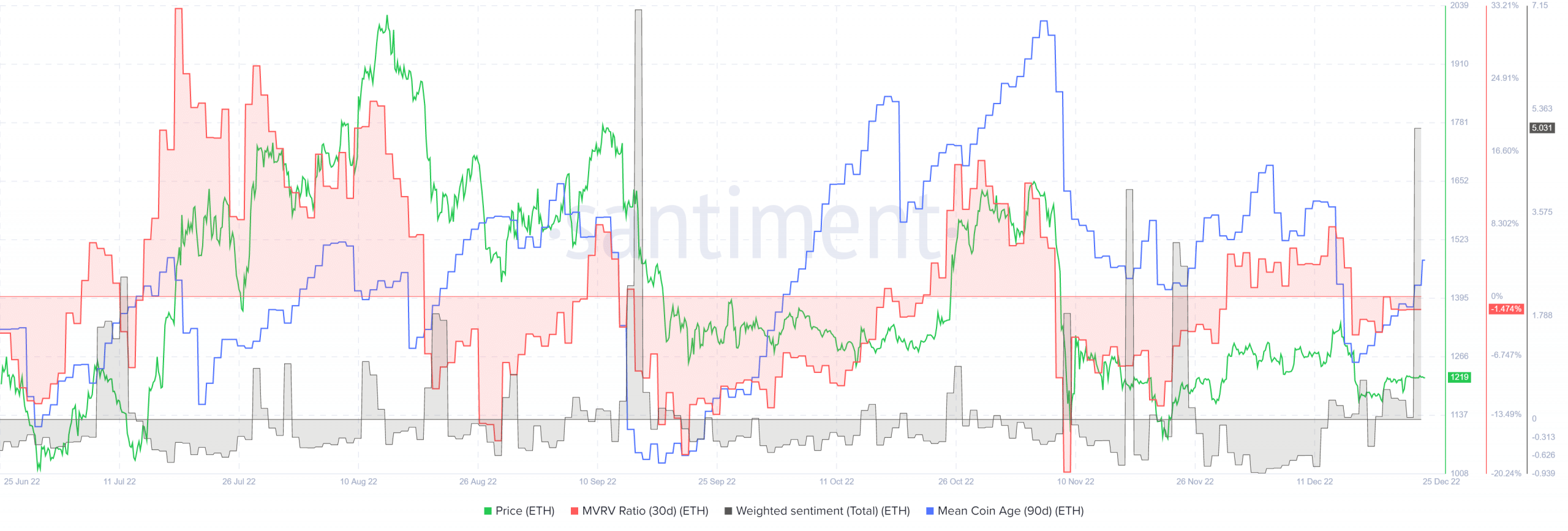

Supply: Santiment

The Marketplace Price to Learned Price (MVRV) ratio (30-day) fell into adverse territory after Ethereum dumped from $1,340 to turn that the asset was once undervalued on shorter time scales. The 90-day imply coin age additionally took successful at the moment. Since then, the imply coin age metric has been on the upward thrust. This confirmed some accumulation.

The weighted sentiment additionally shot upper just lately, however there was once no notable reaction from the cost but. Up to now, a emerging sentiment was once now not essentially bullish for the cost both. As an alternative, buyers will also be cautious of a robust surge within the MVRV ratio as it will probably sign holders are able to take income.

![Ethereum [ETH] rises above $1,210 however is a year-end rally at the playing cards](https://axdtv.com/wp-content/uploads/2022/12/PP-2-ETH-cover-3-1000x600.jpg)