It’s no secret that the marketplace has been tough crusing thus far all over 2022, with buyers taking hit after hit. Alternatively, as of late and the previous day’s sturdy fee motion turns out very promising when taking a look ahead.

We now have all change into too aware of the tough macroeconomic scenario we’ve discovered ourselves in popping out of a once-in-a-lifetime form of pandemic. Inflation has soared, provide chains had been disrupted, and effort prices have shot throughout the roof.

Alternatively, there were a couple of shiny sectors all over the 12 months. One such instance is the Zacks Oil and Power Sector, which lately ranks #1 out of all 16 sectors.

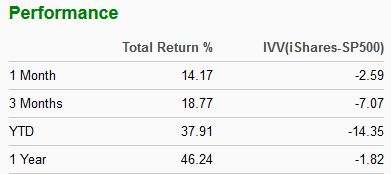

The desk under presentations the field’s efficiency in different other timeframes.

Symbol Supply: Zacks Investment Research

Two firms that perform inside the sector come with Exxon Mobil XOM and Chevron CVX. Being two of the highest oil giants raises a sound query: Which corporate merits your hard earned money extra?

Let’s check out valuation ranges, forecasted backside and top-line expansion estimates, and dividend metrics to get a extra actual resolution.

Exxon Mobil

Exxon Mobil XOM stocks had been blistering sizzling year-to-date, offering buyers with a large 63% go back and simply outperforming the S&P 500’s decline of 15%. Stocks had been on a powerful uptrend all 12 months.

Symbol Supply: Zacks Investment Research

XOM lately has a ahead price-to-sales ratio of one.1X, which is only a tick above its median of one.0X during the last 5 years however is particularly under 2018 highs of one.4X. Moreover, the price represents a steep 75% cut price relative to the S&P 500’s ahead price-to-sales ratio of four.1X.

Symbol Supply: Zacks Investment Research

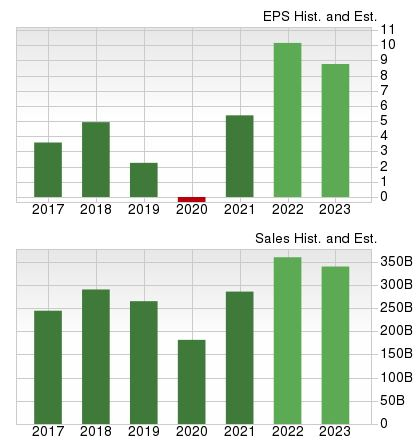

Analysts had been swiftly revising their income estimates around the board during the last 60 days. For the impending quarter, the $2.76 EPS estimate displays a large triple-digit expansion in income of 150% from the year-ago quarter.

Moreover, the Zacks Consensus Estimate Development has climbed broadly as much as $10.17 in step with percentage for the present fiscal 12 months, exhibiting a considerable 90% building up within the bottom-line year-over-year. Taking a look ahead a little additional, the $8.81 EPS estimate for FY23 has the bottom-line shrinking a regarding 14% when in comparison to FY22.

Moreover, the bottom-line is anticipated to enlarge by means of a notable 21% over the following 3 to 5 years.

For FY22, the Zacks Consensus Gross sales Estimate sits at $360 billion, notching an building up within the height line of a large 26%.

Symbol Supply: Zacks Investment Research

XOM’s annual dividend yield sits at 3.09%, with a payout ratio sitting at 52% of income, which might be observed as unsustainable. Alternatively, Exxon Mobil has raised its dividend 3 times out of the previous 5 years, offering a five-year annualized dividend expansion fee of a powerful 3.09%.

XOM is a Zacks Rank #2 (Purchase) with an general VGM Rating of an A.

Chevron

Chevron CVX stocks had been sizzling sizzling as smartly year-to-date, offering a stellar go back of 55% that places the S&P 500’s efficiency to disgrace.

Symbol Supply: Zacks Investment Research

The oil massive’s ahead price-to-sales ratio sits at 1.6X, which is moderately under its prime of one.9X in 2020 and is moderately above its median of one.5X during the last 5 years. Moreover, the vale represents a considerable 63% cut price relative to the S&P 500’s ahead price-to-sales ratio.

Symbol Supply: Zacks Investment Research

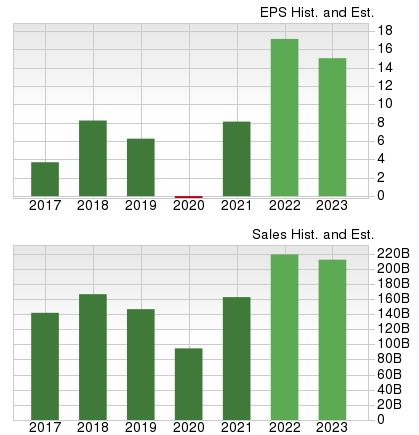

During the last 60 days, analysts had been upwardly revising their income outlook around the board. The $4.65 EPS estimate for the impending quarter displays a large triple-digit expansion in income of 171% in comparison to the year-ago quarter.

For FY22, the Zacks Consensus Estimate Development has climbed 32%, exhibiting a surge in income expansion within the triple-digits of 108% year-over-year. Alternatively, for FY23, the $15.00 in step with percentage income estimate represents the bottom-line lowering by means of 11.5% year-over-year.

Moreover, income are forecasted to develop by means of 12% over the following 3 to 5 years.

Taking a look at income forecasts, the $218 billion estimate for FY22 gross sales presentations a large 35% enlargement within the height line from FY21.

Symbol Supply: Zacks Investment Research

For buyers searching for a circulate of source of revenue, CVX has that lined with its 3.22% annual dividend yield with a payout ratio sitting at 54% of income. During the last 5 years, Chevron has larger its dividend 5 occasions; the five-year annualized dividend expansion fee sits at a notable 5.9%.

CVX is a Zacks Rank #3 (Cling) with an general VGM Rating of an A.

Backside Line

Each firms have indubitably loved a stellar run all over 2022, and selecting between the 2 is not any simple selection.

In occasions of general marketplace weak spot, buyers want to be able to pivot to sectors which can be appearing moderately smartly, such because the Zacks Oil and Power Sector.

Buyers inside this sector have loved a mess of positive aspects, indubitably proscribing drawdowns in different portfolio positions.

When it comes all the way down to it, I imagine that XOM can be a greater play over CVX, and there are a couple of the explanation why.

XOM presentations extra sexy valuation ranges, has a far upper forecasted long-term income expansion fee, and, most significantly, lately has a better Zacks Rank than CVX.

Simply Launched: The Greatest Tech IPOs of 2022

For a restricted time, Zacks is revealing essentially the most expected tech IPOs anticipated to release this 12 months. Considerations about Federal rates of interest and inflation led to many personal firms to stick at the bench- resulting in firms with higher logo popularity and better expansion charges entering the sport. With the power of our financial system and file quantities of money flooding into IPOs, you don’t wish to omit this chance. See all the listing as of late.

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

The perspectives and critiques expressed herein are the perspectives and critiques of the writer and don’t essentially mirror the ones of Nasdaq, Inc.