Sam Bankman-Fried, the founding father of FTX and previous CEO, spoke with New York Occasions and CNBC host Andrew Ross Sorkin in a extremely expected interview on Wednesday that were booked prior to FTX imploded. And it was once a grasp magnificence in spin.

Bankman-Fried, extra regularly referred to as SBF, joined just about from the Bahamas and spent the interview time and again adopting the posture and cadence of a 15-year-old child stuck with a baggie of weed in his sock drawer. However SBF wasn’t stuck smoking weed by way of his oldsters and he’s now not a youngster. The 30-year-old graduate of MIT misplaced billions of bucks in person deposits—the lifestyles financial savings of normal folks, in some circumstances—on his crypto buying and selling platform FTX, an organization that had a valuation of $32 billion prior to mentioning chapter on November 11.

SBF has spent the previous 3 years development a private emblem that combines the laid-back, hoodie-wearing techie of early-Fb Mark Zuckerberg with the single-minded focal point of a host cruncher like Michael Burry, performed by way of Christian Bale in 2012’s The Large Brief. Toss in some heavy use of prescription uppers and also you’ve were given a boy genius who simply desires to make the arena a greater position together with his magic web cash.

That symbol of the intense kid was once touted on magazine covers, right through TV interviews, and at meetings the place SBF was once wearing shorts and a t-shirt whilst sitting subsequent to former British High Minister Tony Blair and previous U.S. president Invoice Clinton. And it allowed SBF to create an empire constructed on pretend cash, within the type of now not simply bitcoin and ethereum however two cryptocurrencies he created himself known as FTT and Serum. SBF used this junk as collateral to make huge bets together with his hedge fund Alameda Analysis, and it was once the ones dangerous bets, made by way of taking buyer deposits thru one way recognized within the criminal occupation as “fraud,” which in the end ended in the corporate’s downfall in a spectactularly quick time period.

Sorkin were given in various questions right through the 1 hour and 13 minute dialog, however SBF was once virtually all the time ready to make it sound like he was once simply making truthful errors. Sorkin requested SBF in regards to the co-mingling of budget between FTX and Alameda Analysis, an entity he technically wasn’t intended to have any regulate over. However even a few of Sorkin’s questions have been infantalizing and allowed audience to empathize with the concept that SBF was once little greater than a kid who were given in over his head.

G/O Media would possibly get a fee

“While you learn the tales, it seems like a number of youngsters who have been on Adderall having a sleepover birthday celebration,” Sorkin mentioned to laughter from the audience in New York.

“Glance, I screwed up. I used to be CEO. I used to be the CEO of FTX. And, I say this over and over again, that…. that implies I had a accountability, that I used to be accountable in the end for us doing the appropriate issues. I imply, we didn’t. We tousled large,” Bankman-Fried mentioned, his head placing low.

And that conciliatory tone was once a part of a relentless chorus that, in fact, landed like a weaponized apology. SBF would take accountability, or a minimum of appear to be he was once taking accountability, and say that he merely tousled by way of now not managing dangers correctly. And all of it got here throughout as one thing shall we empathize with. Sorkin would then move on to invite about SBF’s oldsters, each regulation professors at Stanford.

“Your oldsters are regulation professors. What did you inform them when all of this came about?” Sorkin asks at one level.

Placing apart the obscure phraseology in a line like “when all of this came about,” for a 2nd, who offers a shit what SBF’s oldsters recall to mind the location? Attempt to consider actually every other particular person accused of criminal-level impropriety with buyer budget getting requested a softball query extra in step with junior top gossip. To his credit score, Sorkin additionally requested about the true property purchases within the Bahamas that SBF’s oldsters have been it appears signatories on—a query SBF didn’t supply an excessively transparent resolution, similar to the remainder of the interview. However SBF was once obviously granted leeway in a way that’s exhausting to consider any person like Elizabeth Holmes getting within the aftermath of the fraud at Theranos, to mention not anything of a Ponzi scheme personality like Bernie Madoff.

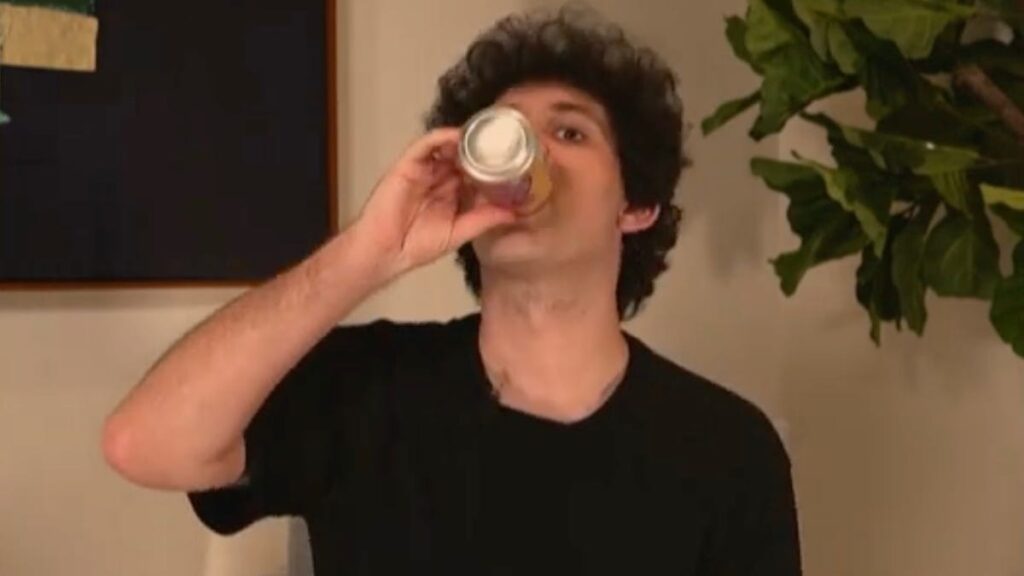

Even SBF’s repeated beverages of a few canned beverage helped created the delicate symbol that this was once a juvenile who couldn’t actually be held accountable for his movements. And it’s exhausting to not consider that impact was once planned, similar to the remainder of his slovenly personality.

The interview even ended with a spherical of applause for SBF from the target audience—individuals who reportedly paid over $2,000 a head for the risk to wait the convention in New York. It was once an excessively bizarre second from the target audience, possibly simplest exceeded once they all laughed at SBF announcing he “had a nasty month,” as regardless that it was once a line from a sitcom.

Possibly it was once all perfect summed up by way of Kevin O’Leary, a former paid spokesman for FTX who additionally misplaced cash right through the implosion of FTX. O’Leary quote-tweeted Invoice Ackman on Wednesday, who mentioned he believed SBF after gazing the interview, suggesting possibly that it was once all a number of truthful errors.

“I misplaced hundreds of thousands as an investor in @FTX and were given sandblasted as a paid spokesperson for the company however after being attentive to that interview I’m within the @BillAckman camp in regards to the child!” O’Leary tweeted.

The child. The 30-year-old child.

George Stephanopoulos of ABC Information not too long ago flew right down to habits his personal interview with SBF within the Bahamas, which is anticipated to air on Excellent Morning The us on Thursday morning. However right here’s hoping outdated George will squeeze some exact information out of his interview. As a result of whilst Sorkin’s interview on Wednesday would possibly supply some alternatives for eagle-eyed legal professionals hoping to catch SBF in some contradictions, it was once obviously an try by way of SBF to control the narrative by way of showing to provide contrition for the cave in of FTX, whilst getting away with a gradual slap at the wrist as a result of he’s only a younger 30-year-old boy, in spite of everything. The idiotic boy genius.