Even though the affect of the worldwide pandemic continues to be being felt within the business place of work area marketplace, many portions of the arena are actually shifting against dwelling with the COVID-19 fairly than running with strict restrictions, place of work leasing knowledge displays.

With 5.4 million sq. toes of internet occupancy progress throughout the United States, place of work leasing charges within the fourth quarter of 2021 have been certain for the primary time because the onset of the pandemic. Main the uptick: leasing charges in secondary-growth markets (towns with populations between 1 and 5 million other folks).

Tech remained the dominant leasing driving force throughout the finish of 2021, representing 21% of This fall task, in line with Jones Lang LaSalle IP (JLL), a business actual property and funding control services and products company. Top-tech corporations endured to dominate the place of work leasing area, including about 3.3 million sq. toes of leased place of work area within the quarter.

“Giant tech, basically, has expanded by means of 10.1 million sq. toes over the process the pandemic,” mentioned Phil Ryan, US analysis director at JLL.

Jones Lang LaSalle IP

Jones Lang LaSalle IPAdministrative center leasing charges, then again, are nonetheless beneath pre-pandemic ranges, although tenant call for is anticipated to upward push incrementally all over 2022 because of favorable stipulations, the JLL report said.

For the primary time in two years, extra place of work area was once leased than vacated in This fall 2021. General, leasing task rose by means of 9.2% within the remaining 3 months of 2021, bringing quarterly volumes to 71.3% of pre-pandemic norms.

Leasing and occupancy, then again, are two various things. Leasing refers to area anticipated to be occupied, no longer exact staff seated at the back of desks.

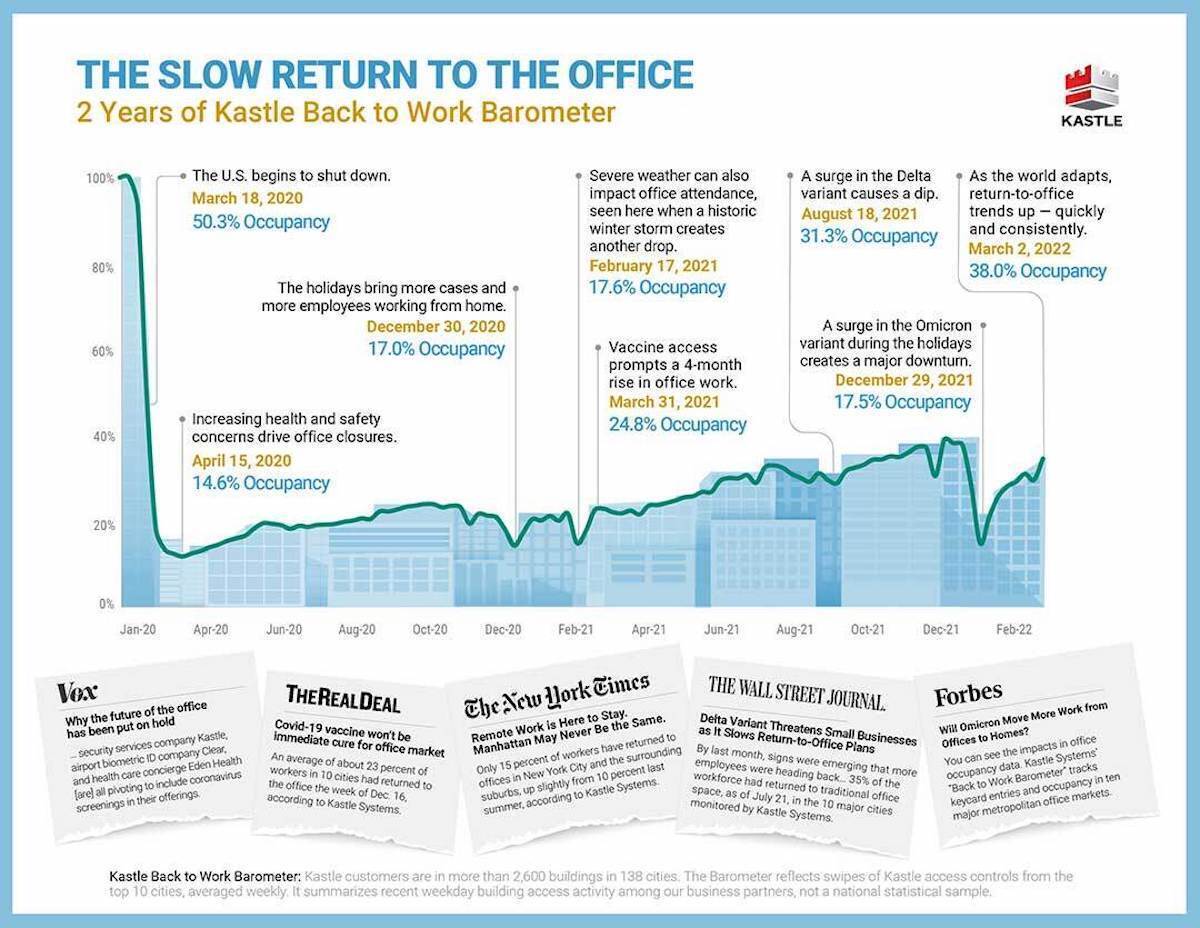

This month, the common occupancy charge on Kastle Machine’s Back to Work Barometer rose to 40.5%, up from 39% in November 2021. That is the easiest charge since March 2020, and each town at the Again to Paintings Barometer noticed occupancy features. (The barometer measures occupancy charges in 10 metropolitan spaces, together with New York Town, Chicago, Houston, and Washington D.C.)

Kastle Programs

Kastle ProgramsKastle Programs Again to Paintings Barometer.

Kastle Programs is a controlled safety supplier to greater than 10,000 firms globally; it makes use of worker badge-swipe knowledge to resolve office occupancy.

In step with office era company Freespace, then again, US place of work occupancy charges charges were on a roller-coaster journey over the last 4 months, shifting between 11% occupancy in November, 2021, to a few% in January, and in spite of everything elevating again as much as 6% this month.

In early Might, 2021, only one in 20 place of work structures in the United States had occupancy ranges above 10%, and as just lately as remaining month occupancy charges averaged simply 16%. Taking a look forward to 2022, about one in 5 places of work are anticipated to be empty, in line with Moody’s Analytics, a consultancy.

“We’re nonetheless on the level the place nearly all of other folks aren’t even in an place of work,” Ryan mentioned. “When it comes to call for shifting ahead, the overall consensus is there can be a internet lower within the call for of area with dating to current footprints. For the marketplace total, then again, it’s much less sure, as a result of there may be internet progress with regards to the hard work power and with regards to the full quantity of people that’ll want some degree of place of work get right of entry to.”

Freespace

FreespaceUS occupancy ranges, 2021-22.

Uncertainty stays a key theme going ahead as a result of there are nonetheless considerations round new Covid variants, rising geopolitical problems and increased inflation, the JLL document mentioned.

Whilst leasing task is up, place of work vacancies also are anticipated to pattern up all over 2022 because of development completions begun previous to the pandemic and company place of work consolidations.

One pattern affecting occupancy volumes is a consolidation of current area; in different phrases, organizations are making extra environment friendly use of the distance they have got already leased to house a hybrid body of workers. Some other pattern is extra organizations are opting for to hire new or renovated structures over older inventory. Increasingly, older place of work area is being transformed into residential area or senior dwelling or assisted dwelling amenities, according to Peter Miscovich, managing director of JLL.

“There may be top class to be paid for sophistication An area in New York, Boston, San Francisco, and London,” Miscovich mentioned in an eariler interview. “I don’t suppose we’ll ever go back to the behaviors of December 2019 and earlier than ever once more.”

Jones Lang LaSalle IP

Jones Lang LaSalle IPMost of the elegance B and C place of work areas and extra out of date suburban campus places — or older, city development inventory — could also be taking a look at obsolescence or repurposing, as was once additionally the case all through the Nice Recession, Miscovich mentioned.

Magnificence B and C structures are in most cases older actual property, or the ones positioned in a suburban environment, with fewer facilities and lower-tech infrastructure. Previous to the pandemic, many older structures have been regarded as fascinating as a result of they have been more economical to hire.

Firms also are adopting extra of a collaborative area or “hot-desking” type, the place desks are shared, relying on scheduled place of work paintings days, Ryan defined.

“A bigger percentage of other folks gained’t have an enduring table,” Ryan mentioned. “For the full marketplace, with regards to call for you’ll be expecting a significant lower in place of work area use over the long run in comparison to the place they’re now.”

Some key towns around the world have fared higher than the full pattern, and occupancy charges have been at the upswing over the last a number of months. London place of work occupancy charges peaked at 42% on March 10, the easiest unmarried day by day charge within the capital since earlier than the pandemic in 2020, in line with Freespace. (Freespace’s knowledge is derived from over 120,000 sensors in places of work around the world that measure development occupancy and environmental stipulations.)

General place of work leasing task became a nook in 2021. Leasing task was once up 13.3% year-over-year (YoY), and This fall leasing was once up 29% from This fall 2020, in line with a report by Cushman & Wakeman. That leasing call for is having a adverse affect at the sublease marketplace.

North American sublease stock trended down within the remaining two quarters of 2021, after seven quarters of accelerating stock. Subleasing is a trademark of companies filling empty place of work area, simply as a renter can sublease an condo. So, when sub-leasing tendencies down, it is a trademark that businesses are pulling again to occupying their very own leased areas.

“The timing suits a equivalent trail to the former two recessions when sublease area higher for roughly two years earlier than hitting its excessive level and receding,” a document from Cushman & Wakeman, a world business actual property dealer.

In This fall 2021, North American sublease stock declined by means of 4.8% quarter-over-quarter (QoQ). Present stock is 138.1 million sq. toes (msf), down from 145.1 msf within the earlier quarter.

Whilst business place of work area leasing is ticking up, JLL’s Ryan cautioned COVID-19 surges may just as soon as once more knock again fresh features.

“The overall consensus and sentiment amongst employees round place of work protection and employee mobility [commuting] appears to be returning to customary ranges. It’s simply that place of work re-entry has been held again to this point,” Ryan mentioned. “Clearly, we’ve been right here earlier than, and we all know from time to time this stuff have got derailed, nevertheless it does really feel other this time, particularly as there are not any restrictions any place.”

Copyright © 2022 IDG Communications, Inc.