Arm doesn’t personal factories or produce its personal chips. The corporate designs core semiconductor parts and licenses the blueprints to different corporations in trade for a rate in line with what number of are produced. The association brings in about $700 million in profit each and every quarter, making it one of the most U.Okay.’s biggest tech companies. That’s nonetheless a fragment of the gross sales that tech giants like Nvidia and Intel Corp. generate, and Arm has a moderately small group of workers of 6,000. But few corporations succeed in thus far around the tech ecosystem: Arm estimates that 70% of the sector’s inhabitants makes use of its merchandise every day, and greater than 200 billion chips were made the usage of its generation.

2. The place would I to find Arm’s merchandise?

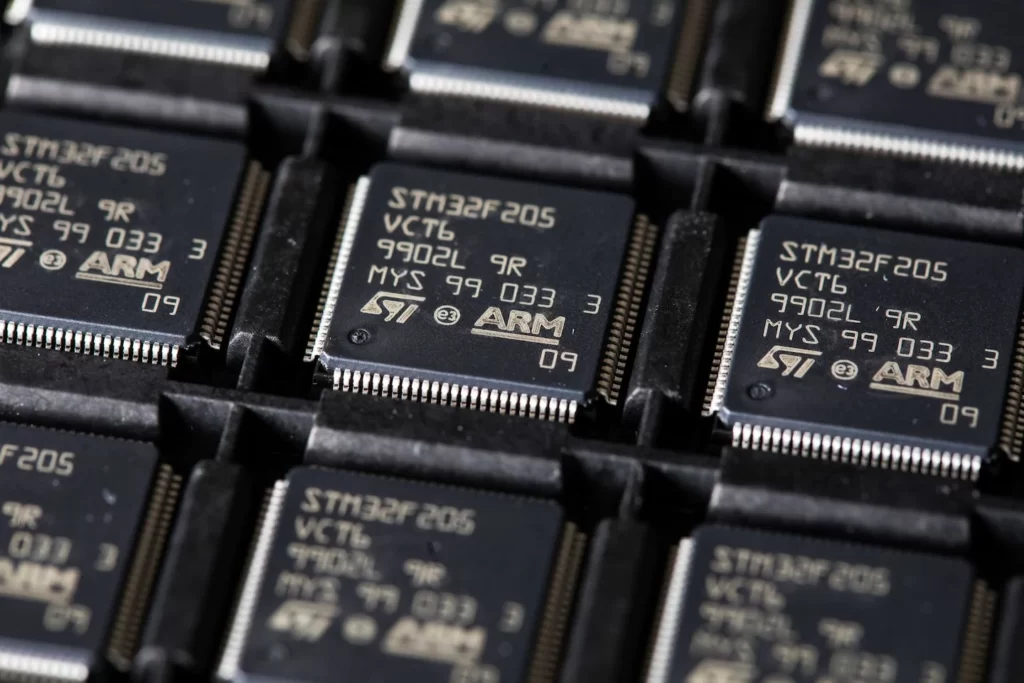

They’re utilized in the entirety from the tiniest sensor to essentially the most tough information heart. Amazon.com Inc., Samsung Electronics Co. and Apple Inc. are amongst Arm’s necessary shoppers. Arm’s instruction set — the elemental code utilized by device to keep in touch with semiconductors — is in billions of gadgets, and the hassle required to modify to every other corporate’s code can be huge. Gadgets that paintings on batteries want chips that may get by means of with moderately little energy; Arm’s designs prioritized that from the outset. When smartphones got here alongside and demanded extra processing horsepower, the generation advanced into extra computer-like chips. There are about 1.4 billion of those pocket computer systems offered annually, with greater than 90% the usage of Arm. Extra just lately, main tech names akin to Apple and Amazon were in quest of to provide their very own chips. Lots of the ones new parts depend on Arm too, and that’s starting to threaten Intel’s profitable cling on high-end computing processors.

3. Why did Nvidia need to purchase it?

Nvidia has thrived by means of parlaying its energy in graphics processors right into a presence in information facilities and synthetic intelligence processing. A deal for Arm would have higher that stretch and allowed Nvidia leader Jensen Huang to push quicker into new spaces akin to automobile chips.

Critics stated the tried Nvidia takeover would threaten a cornerstone of Arm’s good fortune: its neutrality. Arm’s generation has been used around the $550 billion semiconductor trade at the working out that nobody would get privileged get admission to. Apple, Samsung and others had an incentive to make use of it as the root for his or her innovation as a result of Arm’s ecosystem of suitable device and the legions of engineers who know and use it. The U.S. Federal Business Fee sued to dam the acquisition in December, announcing it could hobble innovation and undermine Nvidia’s opponents. The Ecu Union and the U.Okay. additionally investigated, with government in London highlighting Arm’s position in crucial nationwide infrastructure and armed forces apparatus. Chinese language generation corporations that depend on Arm, together with communications large Huawei Applied sciences Co., complained to native regulators too. They have been involved that Nvidia — below power from the U.S. govt — would possibly pressure Arm to bring to a halt Chinese language purchasers. A dispute between Arm and the top of its China trade difficult issues additional. After the deal collapsed, SoftBank started pursuing an IPO for Arm, reverting to a plan from previous to the Nvidia be offering.

SoftBank stated it plans to provide stocks in Arm to the general public earlier than the top of its present monetary 12 months, which leads to 2023. Reviews range extensively about what Arm is value and whether or not SoftBank will even get again its unique funding. Few consider the Eastern corporate will earn a payday as large as it could have had the Nvidia transaction long gone forward. Nvidia had agreed to shop for Arm for a mix of money and inventory, which was once value about $40 billion when introduced in 2020 and rose to greater than $60 billion because the bidder’s stocks climbed. Arm is months clear of an providing, and it hasn’t but disclosed the type of detailed monetary knowledge that traders will want to see. Nonetheless, the corporate is most probably value $25 billion to $35 billion in line with the trade’s valuation metrics and analysts’ early projections. Arm’s profit for the closing three hundred and sixty five days is ready $2.6 billion. That will make the corporate value about $24 billion if traders worth it on the reasonable marketplace capitalization-to-revenue ratio of the Philadelphia Inventory Change Semiconductor Index. SoftBank at the start paid $32 billion when it received Arm in 2016.