Monetary control startup Mesh Payments has landed $60 million in new investment, 10 months after its last raise.

Based in Israel and now with headquarters in New York, Mesh Bills is one among a rising workforce of startups excited about serving to corporations organize their spend thru automation.

It’s a scorching and crowded area that incorporates the likes of Ramp, Brex and Airbase, and extra just lately, TripActions and Rho, amongst others.

For its phase, Mesh says it noticed its income run fee triple within the first part of 2022, since its November 2021 lift. The corporate as of late has over 1,000 shoppers and just about $1 billion in annualized fee quantity (TPV) flowing thru its platform.

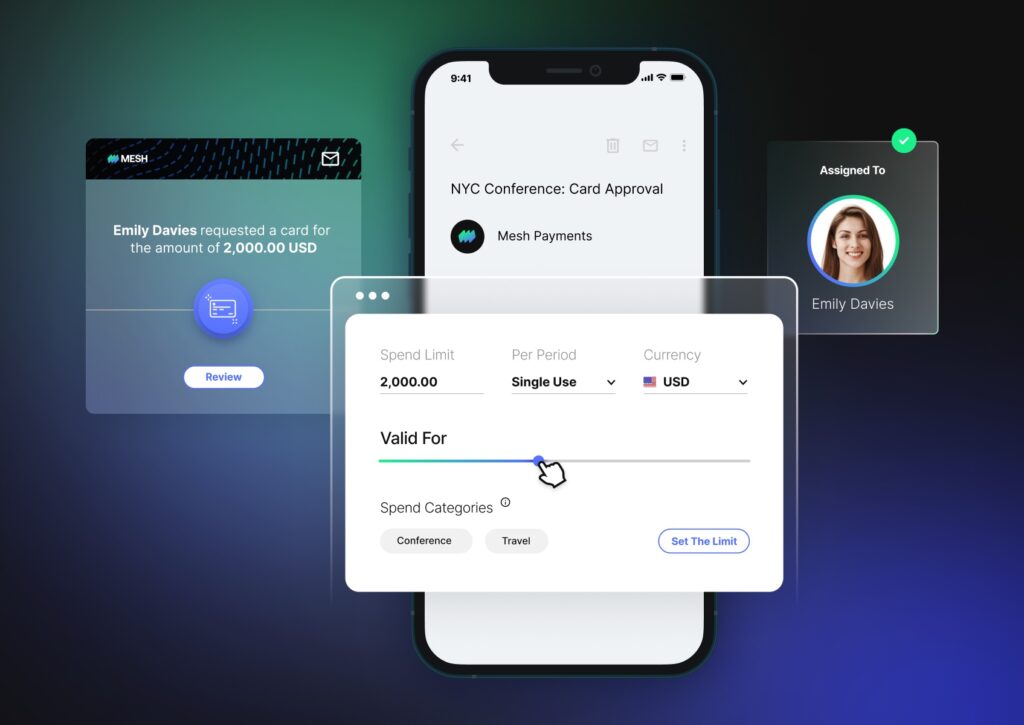

Put merely, Mesh targets to lend a hand its shoppers automate, and get real-time insights about, their spend. Like its competition above, it additionally has a company card providing. However uniquely, in keeping with Mesh co-founder and CEO Oded Zehavi, it additionally gives a numberless company card, which he describes as “the business’s best numberless VISA bodily playing cards with the versatility, keep an eye on, and safety of digital playing cards.”

“We additionally be offering extra integration into organizational programs that may herald insights that don’t seem to be best pushed by way of fee transaction themselves, but additionally supply insights past how a lot you spend,” he added. The corporate is helping shoppers organize spend starting from go back and forth and expense (T&E) to SaaS subscriptions.

Regardless of the expanding collection of competition, Zehavi believes that the “marketplace alternative continues to be huge.”

Alpha Wave led Mesh’s newest financing, a Collection C which closed previous this month that incorporated participation from present backers, together with Tiger World, TLV Companions, Entrée Capital and Meron Capital. Its overall raised up to now is $123 million.

“Earlier traders used the professional rata rights that that they had, and are including extra past the rights that that they had as a part of this spherical,” Zehavi stated. “We will be able to have many of the Collection B within the financial institution, however we needed to have sufficient money to develop and scale on the present fee.”

The manager declined to proportion Mesh’s new valuation, announcing best that it was once a “vital up spherical.”

In his view, the corporate was once “disciplined” when it got here to valuation.

“A large number of rounds this present day are flat or down rounds, particularly in our area — many corporations raised at top multipliers in comparison to income generated,” Zehavi informed TechCrunch in an interview. “Our industry has tripled, however we saved the similar multiplier, which allowed us to extend our valuation above the former spherical.”

When requested about arduous income figures, the chief pointed to his corporate’s annual run fee quantity of $1 billion, and the truth that it’s producing just about 2.5% interchange out of it to present a glimpse of “a ballpark quantity” of the place Mesh is at from a income point of view.

The corporate’s candy spot is the midmarket, with shoppers similar to Monday.com, Hippo Insurance coverage, Sezzle, Riskified, and Snyk, amongst others.

Lately, Mesh has about 150 staff, with its product and R&D purposes being led out of Tel Aviv and gross sales and advertising within the U.S. It boasts a C-suite this is 60% girls, together with its COO, CFO and CPO.

The corporate plans to make use of its new capital most commonly towards “doubling down” on its R&D funding, in addition to towards its go-to-market technique.

“We’re amazed by way of the adoption and alternative that the distance brings,” Zehavi stated. “And we see see that banks are nonetheless no longer taking any motion.”

Mesh claims that its shoppers are “5x extra environment friendly” and thus their finance groups on reasonable save 3 days a month by way of the use of its providing.

Previous this 12 months, Mesh partnered with world payroll supplier Papaya World in an effort “to take away friction from worker expense control.” It plans on different, identical partnerships at some point.

Rick Gerson, co-founder, chairman and leader funding officer of Alpha Wave World, notes that “the most productive CFOs wish to get essentially the most out of each and every greenback and hour, specifically right through instances of financial turbulence.”

“The collection of corporations which are open to discovering new and higher tactics to spend much less and save extra is lovely huge and the Mesh workforce brings a best-in-class resolution this is frequently bettering,” he stated in a written commentary.