Even before President Joe Biden’s White House Executive Order (EO) last week, the US had been exploring the creation of a Central Bank Digital Currency (CBDC). But its efforts have fallen far short of other countries.

In the Executive Order, Biden called on several US agencies and regulatory bodies to intensify their exploration of a digital form of a dollar, similar in some ways to cryptocurrencies, such as bitcoin, but vastly more stable. Biden called on the Federal Reserve System (The Fed) and other oversight bodies to develop recommendations on how to close regulatory gaps, mitigate economic risks, and address cybersecurity concerns around cryptocurrency.

Currently, however, the US is playing a game of catchup with other countries that are already using or piloting CBDCs or digital tokens. The consquences of the US falling further beyind could be serious.

“I think the United States has realized it’s very far behind other countries, especially China, which is racing ahead technologically and also policy wise,” said Ananya Kumar, assistant director of Digital Currencies at the Atlantic Council’s GeoEconomics Center, in Washington DC.

“If we don’t create our own, standards will get set by other countries already aware of the advantages of this innovation and the US will be left behind,” Kumar said. “The EO came out very strongly for American leadership on these issues. The US to date has not been focusing coordinated efforts on this.”

Members of the Atlantic Council, a think tank, testified before Congress last summer on the merits and challenges of CBDCs, which are faster, cheaper to administer, and safer than cryptocurrencies — or even traditional cash.

“It still is a wild west show and we need regulatory clarity to tame it,” said Avivah Litan, a distinguished analyst and vice president at research firm Gartner. “Regulatory agencies have different views on cryptocurrencies.”

For example, the US Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Treasury and the Internal Revenue Service (IRS) are not unified in their definitions and regulatory treatment for crypto, and regulatory responsibilities and jurisdictions are not clear among them (e.g. across/between the CFTC and the SEC), Litan explained.

“There are also multiple competing efforts in Congress for crypto-related legislation, most of which have not passed,” Litan said. “Hopefully, the Executive Order will clarify the roles and how cryptocurrencies are treated going forward.”

Of the countries or regions with the four largest central banks — the US, the European Union, Japan, and the UK — the United States is furthest behind, according to the Atlantic Council. And China has been expanding the pilot program of its retail CBDC — the e-CNY — while concurrently banning the use of cryptocurrency. Nigeria launched its CBDC, the e-Naira, in October 2021 for retail use.

“China, Thailand, the UAE, and many other countries are also exploring cross-border projects, a testament to their interest in setting technology and policy standards internationally,” Kumar said in a blog post last week.

One problem with the lack of international standards and regulatory oversight is that cryptocurrencies can be used by criminal groups for nefarious activities and rogue nations to bypass traditional financial messaging networks. For example, faced with a growing number of sanctions following its invasion of Ukraine, Russia is likely using cryptocurrencies to continue cross-border commerce anonymously.

“To begin with, privacy and consumer protection standards are needed,” Kumar said. “Europe currently leads the world with that and anyone who wants to do commerce with them has to comply with those standards. It’s a very fragmented system currently, and that’s where you need international bodies to create standards that will work to your advantage.”

Digital currency, including cryptocurrencies, have seen explosive growth in recent years, passing a $3 trillion market capitalization last November (up from $14 billion just five years earlier). Surveys suggest that around 16% of adult Americans — approximately 40 million people — have invested in, traded, or used cryptocurrencies. More than 100 countries are exploring or piloting CBDCs, a digital form of a country’s sovereign currency.

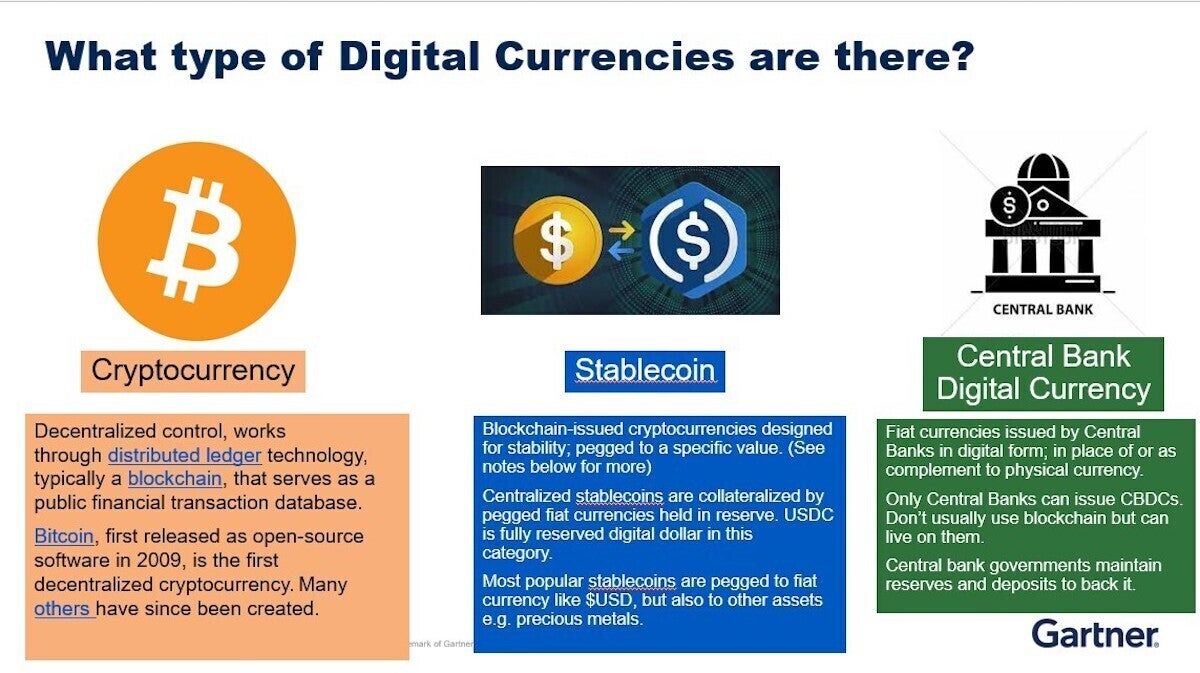

Generally speaking, there are three kinds of digital currency:

- Cryptocurrencies, such as bitcoin and Ethereum, created and traded on blockchain distributed ledger technology (DLT);

- Stablecoin, such as Tether and USD Coin, backed by fiat currencies like the US dollar;

- Central Bank Digital Currency (CBDC), or fiat currencies issued by central banks in digital form and are not categorized as cryptocurrency.

People who buy and sell digital currencies use digital wallets that contain public and private encryption keys. The public keys are used to send or receive digital coins; the private keys help ensure no one can steal it from the holder, as only they hold the code. The digital currency transactions are recorded through an online electronic ledger that in the case of CBDCs is typically managed by a central bank. In contrast, cryptocurrencies, such as bicoin, are transferred and tracked on a public electronic ledger called a “blockchain,” which is maintained by digital currency “miners” or the people who use computers to generate cryptocurrency.

Cryptocurrencies offer sellers and buyers anomymity through encryption, but that same encryption ensures transactions are unchangeable or immutable.

There are, however, some CBDC projects that use blockchain distributed ledger technology (DLT) — the same technology used by bitcoin and other public cryptocurrencies.

Sweden, for example, is testing a blockchain DLT for its digital currency, and those currencies can interact with other CBDCs. For example China’s Digital Yuan can be transferred using a bridge, gateway, or other interoperability protocol to a DLT/Blockchain “as they have done,” Litan said.

Gartner

GartnerThree types of cryptocurrency.

Banks have already been piloting stablecoin as a method of cross-border payments to augment or replace traditional financial rails, such as SWIFT — the world’s largest financial messaging network.

JP Morgan and Wells Fargo have piloted their own stablecoin to handle internal settlements with their business partners. Unlike cross-border transactions through traditional settlement messaging networks, which can take three days or more to clear, cryptocurrency transactions are nearly instantaneous and there are no fees.

Even before Biden’s executive order, the US had been looking at the creation of a federally-backed digital dollar through Project Hamilton, a collaboration between The Federal Reserve Bank of Boston and the Massachusetts Institute of Technology’s Digital Currency Initiative (MIT DCI).

Project Hamilton’s purpose is to create a CBDC design and gain a hands-on understanding technical challenges and opportunities. “Our primary goal was to design a core transaction processor that meets the robust speed, throughput, and fault tolerance requirements of a large retail payment system,” the Project Hamilton’s executive summary states.

The Federal Reserve also recently published a CBDC policy paper; it is currently in the public comment stage until May 22.

Gartner

GartnerToday, eighty-seven countries (representing more than 90% of global GDP) are exploring a CBDC along with 45 central banks; in May 2020, just 35 countries were considering a CBDC, according to the Atlantic Council.

Nine countries have already launched a digital currency. Nigeria is the latest with the e-Naira, the first CBDC outside the Caribbean.

At the same time, 15 countries have launched CBDC pilot projects to test the waters, including China, Russia, Saudi Arabia and South Africa, Singapore, South Korea and Thailand. “China is much further along than the US, and about a year ago tested a multi-national distributed ledger for cross-border payments with Thailand, the UAE, and Hong Kong,” Litan said.

In 2019, two of the largest economies in the Middle East, the United Arab Emirates and Saudi Arabia, launched a bilateral CBDC pilot project called Project Aber. The project concluded that DLT can successfully facilitate cross-border transactions.

“The project was successful in achieving its key objectives, which include using a new DLT-based solution for real-time, cross-border interbank payments between commercial banks without the need to maintain and reconcile Nostro accounts with each other,” a multinational study concluded. “This promises to address the inefficiency and costs that are inherent in existing cross-border payment mechanisms.”

In February 2021, the United Arab Emirates joined China, Hong Kong, and Thailand in a joint CBDC cross-border test. This “Multiple Central Bank Digital Currency (m-CBDC) Bridge” will test the use of DLT for foreign currency payments, the Atlantic Council said.

Without global standards and international coordination, however, any CBDC-based cross border payment systems could face significant interoperability problems down the road, according to the Atlantic Council.

Kumar said the US needs to move quickly if it wants to catch up to what other nations have been doing.

“The United States has not been focusing coordinated efforts on this, and this is the time that we start thinking about it more seriously than we have,” he said. “Otherwise, we’re going to miss out on the applications of this innovation. We’re going to miss out on how this technology is useful and how regulated innovations can provide financial benefits for our society. And, we’re going to miss out on cheaper, faster, safer payments.”

Copyright © 2022 IDG Communications, Inc.